Seven years ago in Bishkek, the capital of the Kyrgyz Republic, a QR code sticker on a coffee shop would elicit confused glances and bemused smiles. In small convenience stores across this mountainous Central Asian country, such technology simply didn’t exist. Cash was a king, handling over 90% of all transactions. Bank account ownership hovered around 40%, and in rural mountain villages, digital payments seemed like a distant dream from sci-fi movies.

Today, it’s totaly different story. The Kyrgyz Republic now leads Central Asia in QR payment integration, and the numbers tell a story that development economists and policy makers globally should pay attention to.

In just the first six months of 2025, Kyrgyz citizens conducted QR payments worth 274.9 billion soms—nearly 20 times more than the same period in 2024. Since the system’s full scale launch in May 2022, the growth trajectory has been extraordinary: transaction volumes increased 54.6 times, while payment values grew almost 85-fold! By November 2024, the country had processed 42.68 million QR transactions totaling 48.79 billion soms (half a billion USD). For the first quarter of 2025 there had been more than 5.8 million QR payments for public services in amount of 2.6 billion Kyrgyz Soms — 284 times increase by volume and 45.5 times growth compared to the previous year! More than 80,000 QR codes now operate across the country, reaching even the smallest settlements in this nation where rugged peaks often made traditional banking infrastructure prohibitively expensive. By my estimates, the year 2025 willl demonstrate over 300 million transactions with volume of over 500 billion Kyrgyz Soms, ten times increase compared to the previous year 2024!

The remarkable indicators demonstrate a different approach that countries could adopt to reach that staggerings results in just three years!

Let’s just go through existing international context and playbook. The conventional wisdom in digital payments suggested that the Kyrgyz Republic should follow the Western playbook: invest in POS terminal infrastructure, wait for NFC-enabled phones to achieve market penetration, and gradually build acceptance networks for contactless cards and services like Apple Pay, Google Pay, and traditional Visa/Mastercard solutions. This was the established path, backed by decades of infrastructure investment, national programs and global brand recognition.

Yet by 2025, while NFC payment adoption in Kyrgyzstan remained sluggish despite years of promotion, QR transactions were experiencing 20000% year-over-year growth that left traditional payment methods far behind. Traditional Visa and Mastercard POS-terminal payments grew modestly—just 1.5x in transaction volume during 2024, reaching 257.2 billion KGS. E-money payments expanded similarly, doubling in transaction count but growing only 1.4x in value to 41.8 billion KGS.

Why did QR codes succeed where premium payment technologies struggled? The answer lies in examining what worked in other markets. China’s experience with Alipay and WeChat Pay transformed that nation’s payment landscape, with QR codes becoming ubiquitous from Beijing megacities to rural provinces. India’s UPI system, built on similar interoperable principles, has processed billions of transactions and become a model for emerging markets. These examples proved that QR-based payments could leapfrog traditional infrastructure when designed correctly. Kyrgyz Policymakers visiting China and India were so much excited with QR that were very positively welcoming such technology transfer to the Kyrgyzstan during parliamentary hearings.

The contrast is instructive. NFC payments required POS terminals costing hundreds of dollars per unit, compatible smartphones, and merchant buy-in to invest in hardware that serves only one payment method. Google/Apple Pay and similar services add another layer: users must have specific devices and navigate app-based setup processes, requiring local banks to pay for each user 50 cents of initial payments and transaction fee for the platform usage. For a small merchant in a mountain village, these barriers were insurmountable.

QR codes, by contrast, require only a digitally generated code and a basic smartphone camera—technology already in nearly everyone’s pocket of the Kyrgyz citizens. The long term commitment of authorities to investing broadband internet connectivity and 4G mobile coverage favorably played to the QR adoption. The merchants were not required to buy any additional hardware, just download compatiblle mobile apps of commercial banks and fintech companies. Customers just need to scan uniquely generated code and pay in seconds. The infrastructure requirement? A unified standard that makes every QR code work with every payment app.

But the Kyrgyz Republic faced different constraints than China or India: a smaller market of 7 million people, limited resources, fragmented banking infrastructure, and significant urban-rural divides. The question wasn’t whether QR payments could work—China and India had proven that—but whether they could work in a small economy without global tech platforms or government subsidies driving adoption, and whether they could outcompete the inertia of traditional card networks. The answer lay in something more fundamental than technology: treating digital payments as public infrastructure rather than competitive advantage.

When Infrastructure Becomes a Digital Public Good

In 2018, the idea of widespread QR payments in Kyrgyzstan seemed, to many in the banking sector, like something that wouldn’t be feasible for another decade. The country’s financial landscape was fragmented. If a merchant used one bank’s system and a customer used another, payment became impossible. Some had apps, others didn’t. Card versus wallet, bank versus provider—each transaction required matching systems, creating what one observer described as «a quest rather than a purchase.»

That year, Talantbek Omuraliev, the visionary director of the International Payment Center, approached the KG Labs Public Foundation with a proposal: let’s bring stakeholders together. What followed was a series of meetups, discussions, and hackathons focused on fintech and e-commerce development with adoption of QR payment technology. National Bank employees participated throughout, and after a year of collaborative exploration and case study analysis, the regulator adopted a fundamental document for piloting QR payments by late 2019 (ELQR, EL-QR).

In retrospective analysis, the timing proved perfect. As COVID-19 brought urgent focus to contactless payments in 2021, Kyrgyzstan began piloting ELQR (translated as Public or People’s QR), a unified national QR payment standard. This wasn’t mere technical standardization; it was a philosophical shift. ELQR became what we now call Digital Public Infrastructure: foundational systems designed for universal access, much like roads or electrical grids.

Simultaneously, the new country’s leadership took proposal of economist Murad Omoev, adviser to former Prime Minister Sapar Isakov, on digitalization strategy for fiscal authorities eliminated software and hardware lock-in. I remember we had numerous discussions and coffee talks discussing the key challenges of financial inclusion in Kyrgyzstan back in 2018-2019. Murat envisioned that all requirements for specific cash register models should be abandoned removing lobby of specific vendors. The new system operated through APIs that any market player could integrate into their own systems and mobile apps, with QR codes built in as a core transaction method. This parallel development created a foundation for national ecosystem develoment rather than isolated solutions.

Today, 20 of the country’s 21 banks and 7 payment organizations with mobile applications have aligned their QR codes with the national standard and connected to the shared integration infrastructure. As a result, a merchant in Osh, Naryn, or Tashkumyr, anywhere in the country, displays one QR code that works for any customer from any bank. No additional steps. No app juggling. No wallet verification. Just point and pay.

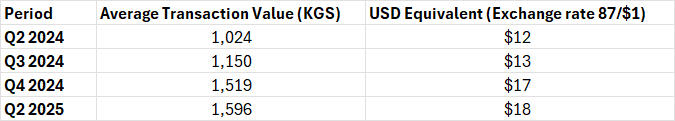

Table: The average transaction value streadily grows

This is Digital Public Goods in practice: open-source, standards-based solutions with minimal restrictions that create public value. Unlike proprietary systems where each provider builds walls around their ecosystem, ELQR opened gates. The infrastructure isn’t owned by any single entity, can be implemented without licensing fees, and treats interoperability as a feature rather than a concession.

Under the current leadership of National Bank Chairman Dr. Melis Turgunbaev, the institution made another crucial decision: eliminating fees for transfers between digital wallets. This removed one of the last friction points preventing mass technology adoption. Recent measures to further systematize QR implementation continue this momentum, positioning the financial sector for sustainable growth.

The most profound impact may not be in transaction volumes but in access. QR payments have become a driver of financial literacy and inclusion. Elderly shopkeepers in remote villages who never used ATMs or visa cards now receive digital payments via smartphones. Young entrepreneurs in provincial towns access the same payment infrastructure as businesses in the capital. The technology that seemed foreign in 2018 now serves as the great equalizer, bringing the unbanked into the formal economy without requiring them to navigate the complexities of traditional banking.

This wasn’t inevitable. It required regulatory vision that evolved from skepticism to piloting to commitment. It demanded coordination between fiscal and financial authorities. It needed private sector innovation working within public frameworks rather than against them. Much of the implementation work had been done under the Prime Minister Akylbek Zhaparov (2021-2024) who orchestrated personally integration of QR transactions across the ecosystem sectors. And it took persistent collaboration between government, civil society organizations like KG Labs Public Foundation and the banking sector.

Lessons for the World

The Kyrgyz Republic’s experience offers insights for any nation grappling with financial inclusion and digital transformation. Small economies can leapfrog traditional infrastructure when they embrace open standards. Public-private collaboration, when genuine, produces outcomes neither sector could achieve alone. And perhaps most importantly, treating core infrastructure as a public good rather than a competitive moat accelerates rather than impedes innovation.

As we observe various countries attempting to digitalize their economies, the Kyrgyz model stands as evidence that economy size doesn’t determine success—vision, openness, cross sector collaboration and systemic thinking do. From the Go board to the mountain villages of Central Asia, the journey of QR payments illustrates how thoughtful infrastructure design can transform not just how people pay, but who gets to participate in the modern economy at all.

As part of the activities of the Internet Society Kyrgyz Chapter I have researched the state of digital public infrastructure in Kyrgyzstan. One of the activities of the KG Labs Public Foundation is to research, design and propose open standards, digital public goods and DPI related to the Artificial Intelligence: from design to technology diffusion and mass adoption. The Kyrgyz Go Federation promotes the game of Go not only in Kyrgyzstan but in Central Asian region.

Related links: https://kglabs.org/news/it-platforms-in-logistics-the-second-meetup-dedicated-to-the-ecommerce-and-fintech-hackathon-2019/

#ELQR #EL-QR #QRKyrgyzstan #QRtransactions #QRpayments #FinancialInclusion #DigitalPublicGoods #DigitalPublicInfrastructure #DPI #InclusiveFinance #CashlessEconomy #FinTechInnovation #DigitalTransformation #InstantPayments #InteroperableSystems #OpenInfrastructure #SmartPayments #SecureDigitalEconomy